I want to preface this blog post by saying many of you readers may see the title options trading and have your eyes immediately glaze over, mind shut down, and want to hit the back button, but before you do that I ask you please please to just read the content presented here. You don't have to know and comprehend all the jargon I may mention, but I want to familiarize your mind with it. If your are new to options, I too was in your position just a couple of years ago before I started trading options just this past year. I am very much a rookie. Those couple of years ago, I had went to library to get books to educate me on options trading, but at the time my mind just wasn't ready, but as I continued to expose myself too it and start to eat this elephant one bite at a time, I realized it's not that hard to comprehend, especially if you begin like me and focus on doing one thing, which for me was writing secure puts and covered calls. So, just expose yourself for now, and try to gather the core of my message in the post and I will continue to hit you with a little options trading here and there in coming post.

***********************************************************************************

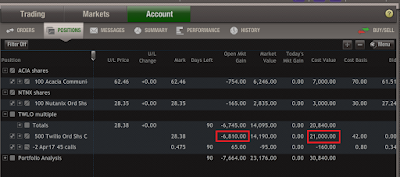

If you have traded options, there comes a time when your account positions may look like this and you wonder, Lord, what am I to do.

A $6,800 Paper Loss

A $6,800 Paper Loss

|

The answer is or at least the answer what I am going to give is it depends. The short of how I got into this position was completely me chasing the higher premiums I got with this high flying stock Twilio, ticker symbol TWLO. The place where it started going down for me is when I had $55 strike price on 100 shares and I would collect a $95 premium. Pretty good for a stock that was hovering around $64 at the time of me selling the put. During that time the stock had hit up as high as $70.49, but all a sudden it started coming down fast on news it was making a second offering. It came down so quickly I was soon in the money as wind up having to purchase the stock at $55. On two more occasions, I sold more puts on Twilio at $53 and $34 and each time I thought for sure it had support and would not hit my strike and all 3 times I had assessed incorrectly. Here I am now with stock in TWLO which I purchased at total of 21K now worth relatively 14K.

making a second offering. It came down so quickly I was soon in the money as wind up having to purchase the stock at $55. On two more occasions, I sold more puts on Twilio at $53 and $34 and each time I thought for sure it had support and would not hit my strike and all 3 times I had assessed incorrectly. Here I am now with stock in TWLO which I purchased at total of 21K now worth relatively 14K.

making a second offering. It came down so quickly I was soon in the money as wind up having to purchase the stock at $55. On two more occasions, I sold more puts on Twilio at $53 and $34 and each time I thought for sure it had support and would not hit my strike and all 3 times I had assessed incorrectly. Here I am now with stock in TWLO which I purchased at total of 21K now worth relatively 14K.

making a second offering. It came down so quickly I was soon in the money as wind up having to purchase the stock at $55. On two more occasions, I sold more puts on Twilio at $53 and $34 and each time I thought for sure it had support and would not hit my strike and all 3 times I had assessed incorrectly. Here I am now with stock in TWLO which I purchased at total of 21K now worth relatively 14K. What Should I Do?

What should I do is what I pondered, should I just sell and take the loss? That is the question I pondered, but I realized one very important thing in this options trading that I do that is I started this in the first place because I wanted a way that I can make additional cashflow in the stock market by selling secure puts and covered calls and collecting a premium to do so. I thought it was excellent way to leverage my cash for cash flow and it's what I have doing since March 2016. Some months, I have collected as much as $1,000 in premium. As of late, as I have battled internal what I should do, I had a eureka moment when I realized just how much options investing is akin to operations in my real estate rental investments. With rental property as long as they are rented and producing positive cash flow, I'm happy and content, and the reason I bought them for in the first place was for the cashflow and not for market appreciation. The same applies for selling puts or covered calls on whatever stock, I was in it again for the cashflow. The market price of the asset be it a stock or real estate can be up or down at even given time, and of course, if I was looking to sell I would be looking to sell at a higher price than I bought if for; otherwise, I might not get what I paid for it at the time. These pressures to buy and sell are always there and for the impatient this could mean loss. The real estate and stock correlation here is similar, except that, either my cash or stock is the asset and selling calls or puts on that asset gets me cashflow.

The Reality

Back to the reality, in the stock market I have a paper loss of about 6K, and if I sell, I will absolutely then realize the loss, but for now it's just a paper loss, much of like how my rentals were at a loss in market value in 2010, but they still rented out and provided positive cash flow, and today those same properties market value is over $140,000. On the stock side of this equation, the question became to me was I still getting cash flow from selling covered calls, in this case from TWLO? Well yes, maybe not as much as some months but each month much like with a lease contract, I signed an contract agreement with a buyer in the options market for 30 days or so that I would receive 'x' amount of premium up front so that he could lease my cash or stock at a set price with the option to buy or sell at any point in time during that term. As long as I have renter/buyer like this, why should I care about the market price of the stock, I thought to myself, as I have patience and have no reason to sell at this must inopportune time. Now, the only time I will be looking to sell is when an unfortunate thing happens that the buyers dry up and are no longer willing to rent. That is when for me when it might be time to realize that loss if the price is still where it is today at $28. If I am no longer receiving premium every 30 days or so then and only then I have loss.

My Next Steps

In speaking of this, since I own 500 shares of Twilio stock, I will be writing covered calls this month and I will make about $150 - $250 in premium,

and my collecting these premiums is actually reducing my cost basis in the stock every month. So yeah, my answer what I should do is clear now, which is sit back and collect money each month. That's all I should care about because my original goal was to get cashflow and I am still doing that. So for the time being, the market value doesn't much bother me as with my real estate prices fluctuate. This has actually taught me a big lesson in patience because the market is very very irrational at times almost like it preys on those short time/short term investors trying to make a quick buck and those mistakes of selling at the most inopportune times can be costly.

By the way the company Twilio is actually a good small company that is making it's way in the cloud computing space which is growing sector with customers like Netflix, Coca-Cola using it's services and it has growing revenues, it will be around. I'm not worried about Twilio, maybe it doesn't get back into the $70 range, but $50 is quite possible. This can happen with most stocks and the likewise would apply. The drawback of options trading is sometimes you might be in this position with a large paper loss and you have to remember why you are in it and if that goal is still being achieved. If so, is there a drawback?

PS: Please share your experience if you are trading options by leaving a comment on this post. Also please be sure share this content to your friends and family if you find it useful. I thank you in advance. You can also see what topics are on deck to the right.

PS: Please share your experience if you are trading options by leaving a comment on this post. Also please be sure share this content to your friends and family if you find it useful. I thank you in advance. You can also see what topics are on deck to the right.

No comments:

Post a Comment