We Are In Debt

When I submit a blog post on a topic that I think will resonate with my readers regarding investment, I'm often disappointed to see the reception is not where I expect it to be, especially when compared to a post on, How to Get Cash Back on Online Shopping. The number of page views is double sometimes in the case for the latter. Though a little disturbing, I understand very well that we have been wired and educated to be consumers but not investors, consumers but not producers. Often so well that we get into all kind of debt being consumers that we have to pay back, are having trouble paying back, or that leaves us no money leftover to invest or do anything else for that matter without potentially going into more debt. So, let me see how this post is going to be received. If it is viewed a lot then that will sort of explain the results more to me of my investment post having so few page views and why the below post ring so true.63% of Americans Don't Have Enough Savings to Cover $500 Emergency

Most Americans Can't Handle a $500 Surprise Bill

Americans Lack Savings

60% of American's Can't Cover Unexpected Expenses

The Desire and Reality Don't Add Up

I know from experience that people want to make more money, and they want to do so in real estate and the stock market from observation in a Rich Dad event I was attending. When the speaker asked the audience who wouldn't mind making $9,000 extra a month, most of the audience hands shot up in the air. These people are going to be upsold on the dream and probably end up in more debt because they aren't serious, but maybe some will make hay with the information, I hope, if they make that investment. As for me personally, I got what I wanted from the free presentation, ideas for what else I can be doing to grow my investments and wealth, which might not have occurred to me and the only thing I spent was my time and the gas to get over there.I digress, back to being in debt. It's been a long time since I had to formally have a plan for attacking debt to pay it down/back, but if I were to do it today, I will demonstrate how I would do so below. Personally, I still have debt myself to manage, but it's only internal to my budget. My wife and I have very little consumer debt (a car payment), but a lot of debt in real estate though. I am of the belief that all debt is not bad debt, but all debt that is taken on should be done so with fair consideration of the impacts to today's and tomorrow's you. Currently, I don't think all debt is assumed with fair consideration on the impacts to the future us, and if we are exceeding our monthly income which we will discuss later, it proves this point. However, let's take a different view and real talk of what debt is as part of this society or societies that allow for credit.

The Debt Control System

Debt is system of control, so let's at least be aware of it and manage the grips it has in its say on our lives. I wrote the blog, A Pivot In Mindset Concerning Personal Finance, to say that it was a change to my mindset that lead to a different result. I think like I do now and act the way I do now so that debt won't control my life all my life. If you have been following my blog, you know I talk a lot about personal finance and investment as if money is real real important to me, but it's not money per se, it's "freedom". Perhaps, you nor I can simply quit our job tomorrow, why because we need money to pay for this, that, or the other. That reiterates my point of debt being a system of control, but what happens when we have money to pay for this, that, or the other for many a tomorrows, then we are in a sense free to do as we please with our life, in an economic sense. So, when Os talks personal finance or investment, please don't take it that I want material wealth --no take it as I want my freedom back and I'll stack this cheese to get out of the rat race.Freedom Gone

Our freedom is gone often before we really have any idea of what is going on, we have mortgaged our future in debt we have to pay for decision we made in our past today that we are still paying in our current today and tomorrow. Think of the progression of us and our youth, we are loaded with student loan debt (supposedly good debt), of course we need a car, so here comes financing for car(s), credit card debt to pay for all the clothes, shoes, tvs, phones, we need right now in our life that we can't wait for, we need a place to stay so we take out a mortgage for housing (this could be good debt and is better in comparison to consumer debt), personal loans for other things we can't afford today, and then hope we get financial literacy along the way and a future job and/or occupation we chose that will pay for it all. For a lot of us, this is the state we are in and it'll be potentially 30 years if we start this in our 20s before we get to break even. So then we are 50, and possibly the whole time we have not invested or invested very little in anything to make our money grow and/or produce positive cash flow, so where does that leave us, I'll tell you, pretty much stuck/controlled until you die! But it doesn't stop there, then this mentality gets passed on and passed on, and next thing you know 1% of the people on earth own and control 22% of it's wealth, which in a way means they to a degree can control us. Sorry, but not sorry, to be so blunt about it. As much as I am saying this to my audience, internally, I'm saying to myself as well. That is my drive and push behind doing well about my personal finance and sharing what knowledge and experience I have with you as well.Get Out of Debt Plan

As for the plan, I can tell you until I'm blue in the face how to get out of debt, but until you want and change your mindset to change your circumstances, nothing will happen and it will only get worst. Getting out of debt can be easy if you have changed your mindset; otherwise, forget it. You can get out of debt and be right back in it like jail recidivism; though this would be debt recidivism.There is no magic bullet, you reduce debt by getting organized about your finances and man/woman up about paying back the creditors you promised to pay. Then, hopefully, becoming a wiser you today when considering taking on debt.

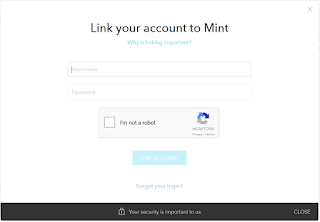

To start, we need to know how much money is coming in and how much money is going out. What do we owe, for how much, at what interest rate. If you have credit card debt, get this organized in a spreadsheet or piece of paper. You may need to reach out to your bank to find out your Annual Percentage Rate (APR) and what are the minimum payment amounts as you will need this information for later. I recommend getting electronic to accomplish this by using a service like Mint.com (create login account if you don't have one). We need to be able to track all our spending and what better way than with technology today. Mint links to most if not all the major banks.

|

| Popular Mint Accounts |

Link all the accounts which you have a balance on and/or that you spend money from so as to facilitate tracking of all your spending.

|

| Link Your Accounts On Mint |

Budget

Part of knowing where our money is going is by setting up a budget, and if we are in debt, you need a budget as debt is indication that we have no idea how much or where our money is going and/or that we show no restraint in terms of our finances. So a budget is a must! No budget, no progress, plus we need it in order to find out if there are any shortfalls in us being able to pay down and eliminate most debt, specifically consumer debt. Being on a budget is like being on a diet because it is restrictive, but we are only restricted by how much money we make. If our lifestyle exceeds this, then we either need to make more money, cutback, or both. Once, we have budget in place we will have a better idea of those 3, which we need to do. In Mint, budgeting and goals are available and we will focus on that here to make our budget. Your budget will look something like this, preferably with a lot less red and more green and yellow. |

| Picture Of Budget |

Quick Steps to Create a Budget in Mint

Once you have a login on Mint.com, under the Budgets tab, click Create New Budget. Then select each of the 21 high level categories listed below, like Auto & Transportation. It should look like the Picture Of Budget above. |

| Choose Each of the High Level Category |

|

| Enter the Total Of All Income Coming Into the Household |

|

| Enter Dollar Amount You Commit to Each Category. Example Bills & Utilities |

|

| Enter Dollar Amount You Commit to Each Category. Example Auto & Transport |

Using Mint for Visual

This budget gives a visual representation of our monthly spending or outgoing money, it doesn't however show past credit card debt in the budget that we have already incurred. What we have to see is whether we have surplus or deficit after your regularly monthly spending is planned. Mint will usually recognize and categorize a lot of your transactions under the correct category for you, but some you will have to do manually. These may show up under Uncategorized tab, so try to find a proper category for them if it isn't Cash and ATM or check.In a budget, there will be items which have a fixed cost each month and some that have variable cost. If you know fixed cost of things you pay, you are going to add up the cost for those and for the variable cost items, you will get the average, and sum the fixed and variable cost together. Then enter that amount under the budget category it best fits in. For example under Bills and Utilities, I listed $600 to cover these items some of which are fixed in cost but others varying, namely water, electric, and gas, but I've listed the average cost of these per month.

I have a spreadsheet I initially use to divide out by category and then sum up and give myself a little buffer in case some months are higher than others.

- Cell Phone - $134 (fixed)

- Comcast Bundle - $200 (fixed)

- Electric - $69 (variable cost)

- Water - $62 (variable cost)

- Gas - $31 (variable cost)

Goals

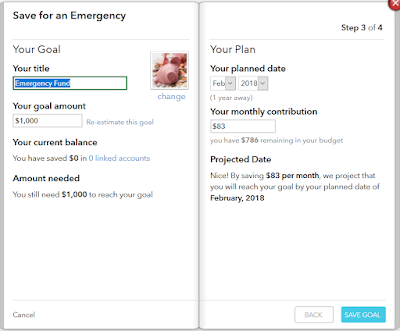

In that budget is a goal to put $50 - $100 towards emergency fund of $1000. Once, $1000 is achieved, you can transition 1/2 to additional investment and 1/2 to debt reduction(if still in consumer debt). If it dips below $1000, start it back up to keep that cushion for emergencies.Steps to Create Emergency Fund Goal

Under the Goals Tab, click Add a Goal, then click save for an emergency and enter the below values. |

| Create Emergency Fund Goal for $1000 |

|

| Open A New Account that offers reasonable interest rate |

|

| Save the Goal |

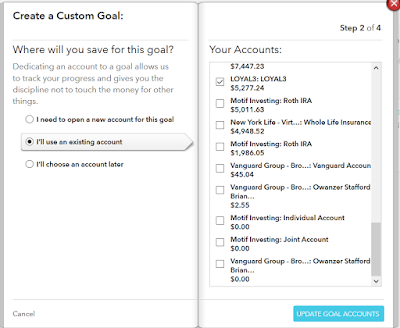

Steps to Create Custom Goal

Under the Goals Tab, click Add a Goal, then click create a custom goal and enter the below values. Each year re-up for another $1200. |

| Create a Custom Goal to Invest $100 into Loyal3 |

|

| Get a Loyal3 Account and link in Mint.com so it's like the screenshot |

|

| Save Goal |

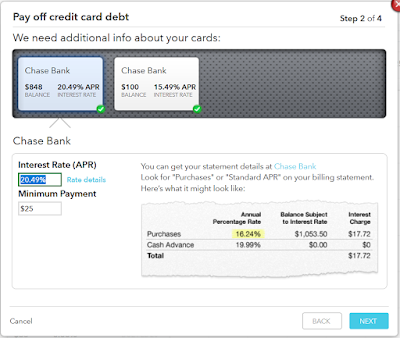

Steps to Create Credit Payoff Goal

We are also going to credit a goal to payoff credit card debt, but it will just be placeholder for the amount we need to pay for our credit card minimum. This will apply against our total income in determining surplus or deficit.Under the Goals Tab, click Add a Goal, then click Pay off Credit Card Debt goal and follow steps for your credit cards. Select any that have a balance on them.

|

| Select All Credit Cards Which Have A Balance |

|

| Use the Information Obtained like in the Screenshot or Contact Your Bank for this |

|

| These Provides You the Min Payment To Be Paid Each Month |

|

| Calendar Representation of the Payoff |

After everything is entered in for the budget and the goals, if there is a surplus, we can attack the credit card debt (since all other forms of financing are fixed, like a car note or personal loan(s) and should be listed in the budget as money spent, we will opt to invest instead of accelerate payment on it), if not

|

| This is example of surplus as there is money left over; otherwise it's a deficit |

you need to make more money and cutback on items in your monthly spending, that are not the emergency fund nor Loyal3 10 Stock Plan (you can take or leave the advice about not cutting out emergency fund and 10 Stock plan, but it's for your own good that you start to choose things which will improve your finances over some other things that don't). Sorry, but you are living above your means and you'll never be out of debt if your monthly expenses exceeds your incoming money and you have credit card debt compounding monthly.

Using Debitize

I am not going to treat you like a baby and tell you not to use your credit cards or to cut them up. Instead, I am going to say use them, but through a service call Debitize. It is for 2 reasons 1.) You improve your credit factors by doing so which can bring up your credit score which can save you thousands if you consider financing in the future for assets, read more in the blog, How To Improve My Credit Score, 2.) So that you can participate in perks of credit cards such as award travel and fraud protections which I discuss in my blog post on Debitize.All the spending is going to be reflected in Mint and you should be watching that the categories stay in the yellow and the green, but if some are red, it is fine as long as the total isn't red because that means you have exceeded your income for that month. Debitize is going to take the money from your account you link as you are spending so at the end of the month you aren't trying to reconcile how to pay off the credit card bill. They have an option to carry a balance and initially the balance we are going to carry is only the one which you had incurred before getting on this reduction debt plan.

|

| Carry Balance Screen Option on Debitize |

This is an extra small payment over and above what is due to start cutting down those balances. It is also good practice to set the due dates on all your credit cards to be at or around the same day each month.

Need to Put In Additional Work

Sorry, we dug this grave for ourselves potentially, so we are going to have to work more to produce more income. Think about what jobs in addition you can do, what can you sell to raise money? Whatever that is, do that and that will go to pay down the highest interest rate credit card debt. Here are some recommendations- Uber driver

- Official/Referee (if you are into sports)

- Task Rabbit jobs

- Virtual Assistant (online)

- Retail sales

- Rent your car on Turo

- Airbnb host

- Food Service

- Overtime at your current job

- Affiliate Marketing

- Garage sale

items in your existing spending for cell service, gym memberships, entertainment, shopping, cable, downsizing cars, anything not a necessity. If you make more money, than these cuts may not be necessary, but remember if we are not still paying down the pre-existing debt, we are still not winning this debt battle. More money is needed to allow for a surplus in your budget so that debt can be paid off. It is a must!

Debt Plan Continuation

Every month, the plan is, you are not going to exceed your total income threshold. For example, your budget should show green or yellow for this topline, unless, your cash can cover you shortfall like the below screenshot of cash to credit ratio.

Any extra money left over is sent to pay down the highest APR credit card balance. So, for instance, the checking account that pays the min payment to cut down all the balances, then an extra additional payment goes to pay down the highest interest rate balance, until it is paid off, then to the next highest and so on and so forth.

Continue on this plan until you are out of all consumer debt and once out of debt continue to manage debt by proper planning of finances for purchases and ensuring those purchases will not exceed your income if added into your budget. Also, focus on acquiring assets instead of liabilities or if you have had tremendous shift in personal finance mentality, use positive cash flowing assets to pay for liabilities.

Subscribe to my blog @ http://oslifemoneypoliticsnotherthings.blogspot.com or on the right side of this page in the Follow by Email box.

Please provide feedback or questions pertaining to this blog post by leaving a comment below. Also please be sure to share this content with your friends and family. I thank you in advance.

Continue on this plan until you are out of all consumer debt and once out of debt continue to manage debt by proper planning of finances for purchases and ensuring those purchases will not exceed your income if added into your budget. Also, focus on acquiring assets instead of liabilities or if you have had tremendous shift in personal finance mentality, use positive cash flowing assets to pay for liabilities.

In Closing

A lot was covered in this post about the reality that we are in too much debt as a result of the programming to be consumers and we largely don't understand that our choices lead to less freedom when we don't understand and manage our debt. A budget is a guide to help us to manage our finances and view if we are on the right track or need a shift in course to reduce debt. If we are in debt, we did it to ourselves, but there are ways to dig ourselves out of it if we are committed to changing our mindset that can get us towards budget surplus and financial freedom. Can this reduce debt plan help you?Subscribe to my blog @ http://oslifemoneypoliticsnotherthings.blogspot.com or on the right side of this page in the Follow by Email box.

Please provide feedback or questions pertaining to this blog post by leaving a comment below. Also please be sure to share this content with your friends and family. I thank you in advance.

No comments:

Post a Comment