Loyal3 has several stocks to choose from and I might have left some off that you might like better, but these 10 are interchangeable with what you are comfortable with. So here are the 10 that I mention a few facts about the company to note. In most cases, I consider myself more a value investor, but on this platform, I tend to throw off that hat and put on another; though some traits prevail when I see stocks with dividend opportunities.

I envision the Loyal3 10 Stock Plan to be where you invest $10 equally in the 10 stocks listed below on a recurring monthly basis, so the order in which you see the stocks are of no bearing. If you have more to invest, then scale it up proportionally. The name of the company and stock symbol are listed. I show you how these stocks have performed for me since investing in them, but please note this is not indicative of what it will be for you due to the price I bought these stocks at the time may be different for you when you start purchasing. It is more to speak to the aforementioned point of investing consistently over time during varying market fluctuations.

The Ten Stocks

Drum roll please.... and the first stock isFacebook (FB)

Social media giant which we all know for services like Facebook, Instagram, WhatsApp, etc.Market Cap: $377 Billion

EPS: $3.47

P/E: 37.71

Div/Yield: -

52 Week Price Range: $96 - $135

ROE: 18%

Type: Growth

Second on the list is

Apple (AAPL)

Biggest market cap company in the world and maker of the infamous iPhone.Market Cap: $680 Billion

EPS: $8.35

P/E: 15.46

Div/Yield: 0.57/1.77

52 Week Price Range: $89.47 - $130.49

ROE: 35%

Type: Value

Third is

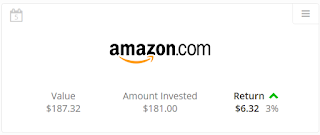

Amazon (AMZN)

Online retailing giant which list and ships damn near any product you can think of.Market Cap: $371 Billion

EPS: $4.90

P/E: 165.29

Div/Yield: -

52 Week Price Range: $474.00 - $847.21

ROE: 14.05%

Type: Growth

Fourth is

Netflix (NFLX)

Online entertainment giant provided it's own and other media content to subscribing customers.Market Cap: $60 Billion

EPS: $0.43

P/E: 329.72

Div/Yield: -

52 Week Price Range: $79.95 - $143.46

ROE: 7.67

Type: Growth

Fifth on the list is

Google (GOOGL)

Online search engine giant that links you to content all over the world by querying with a few words.Market Cap: $560 Billion

EPS: $27.87

P/E: 29.48

Div/Yield: -

52 Week Price Range: $672 - $867

ROE: 15%

Type: Growth

Disney (DIS)

Theme park, merchandise, and media content giant which contain brands such as ESPN, Marvel, Lucasfilms, and Pixar.Market Cap: $174 Billion

EPS: $5.72

P/E: 19.28

Div/Yield: 0.78/1.41

52 Week Price Range: $86.25 - $111.99

ROE: 21.34%

Type: Value/Growth

Seventh is

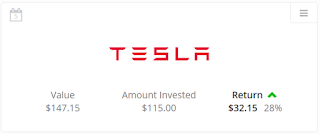

Tesla (TSLA)

This is company of the future with products like electric car, battery technologies, and just recently solar.

Market Cap: $40 Billion

EPS: $(-6.53)

P/E: -(negative)

Div/Yield: -

52 Week Price Range: $141.05 - $269.34

ROE: (-50.96%)

Type: Growth

Market Cap: $40 Billion

EPS: $(-6.53)

P/E: -(negative)

Div/Yield: -

52 Week Price Range: $141.05 - $269.34

ROE: (-50.96%)

Type: Growth

Eighth is

Market Cap: $203 Billion

EPS: $4.61

P/E: 14.44

Div/Yield: 0.50/3.01

52 Week Price Range: $62.35 - $75.19

ROE: 18.56%

Type: Value

Walmart (WMT)

Big box and online retailing giant in consumer goods.Market Cap: $203 Billion

EPS: $4.61

P/E: 14.44

Div/Yield: 0.50/3.01

52 Week Price Range: $62.35 - $75.19

ROE: 18.56%

Type: Value

Nineth is

Market Cap: $85 Billion

EPS: $2.27

P/E: 23.11

Div/Yield: 0.18/1.38

52 Week Price Range: $49.01 - $65.44

ROE: 31.12%

Type: Value/Growth

I don't currently own Nike, but will shortly as it is at value now.

Nike (NKE)

Swoosh, the brand for consumer athletic footwear, apparel, and equipment.Market Cap: $85 Billion

EPS: $2.27

P/E: 23.11

Div/Yield: 0.18/1.38

52 Week Price Range: $49.01 - $65.44

ROE: 31.12%

Type: Value/Growth

I don't currently own Nike, but will shortly as it is at value now.

And finally rounding out the ten is

McDonald's (MCD)

Fast food retailing giant known for Big Mac.Market Cap: $104 Billion

EPS: $5.48

P/E: 22.67

Div/Yield: 0.94/3.03

52 Week Price Range: $110.33 - $131.96

ROE: 127.49%

Type: Value/Growth

One thing to note about the companies above are that their names are ubiquitous around the world, in other words, they are household names you have all probably heard of before. This is my Loyal3 10 stock plan to get you started once you create a login to Loyal3 and set date and amount of $10 to come out of your checking account for each of these stocks on a monthly basis.

The Beauty of It

One reason that I love love this type of platform is because if you don't have the money to purchase a whole share of say GOOGLE, but you still want to partake and any run up that the stock might have, for instance, after an earnings beat and the stock goes up 2%, you get that incremental gain reflected in whatever amount of fractional shares which you own. All while you can still dollar cost average into positions. I think this is why to a degree I have focused more on these types of platforms over some traditional ones like a Vanguard, because I can invest whatever I have right away and not have to save up and chose between maybe more than one urge I have to buy a few different stocks.In Closing

So, $100 a month, every month, invested in some of the most ubiquitous companies in the world which can lead to continual appreciation of the capital you invest over time. |

| My Stock Performance While on Loyal3 |

Links to Loyal3 can be found here under Investing section.

Definitions:

EPS - Earnings per share.

Market Cap - Market capitalization.

Div/Yield - Dividend yield per share/Percentage yield

ROE - Return on equity.

P/E - Price to earning ratio.

Subscribe to my blog on the right side of this page.

No comments:

Post a Comment