We have just begun 2017 and maybe you have aspirations for getting yourself together financially this year and the desire to do so has not yet faded. If you want to do the following:

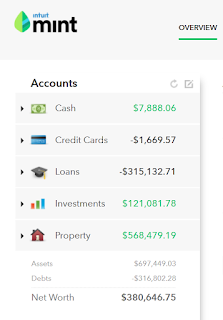

I have to dust off my knowledge on this topic as I have been using Mint every since 2010. I can remember when I was trying to improve my finances and in a retirement seminar it (Mint) was mentioned by one of audience members. I took a note and went home and looked it up online and I've been hooked every since. One of the problems it solved for me was that I could see all of our bank accounts, credit cards, loans, and investments in one centralized place. It gave me just about as complete a snapshot of our financial health as I can think of in one place. For instance, this was great because I no longer had to login to each bank account to see our balances or a transaction as it was all shown in my Mint account. Does this sound like a service you can used to achieve your goal? If so, do not delay, go sign up right now by clicking ==>> here.

Still not convinced if you have made it here, but I still will try to convince you if you are trying to get your financial house in order. What better way if your financial picture is all in front of you either in a graph or simple text? Mint organizes and categorizes purchases if it can identify the merchant which you made the purchase from. I should note one thing here is that to have this tracking and categorizing to happen automatically you need to use some form of an electronic payment like a credit or debit card. If you are doing this you will see items get bucketed under, for example, Auto & Transport or Food & Dining, etc. One of the first things you need to know to get your finances in shape is to know where your money is going and Mint will provide you the nitty-gritty details without need for manual intervention. If I remember correctly, when you get started it gives a template budget based upon looking at your previous 3 months of transactions. You can then edit the budget from there if you need or want to. Personally, I use the budget simply as a guide to see I'm not spending more than I make. By the way, this is the second way to shape up those finances by not spending more than you make. Mint will help you to see if you are doing that. Enough info yet to get you to sign up? Here's the ==> link.

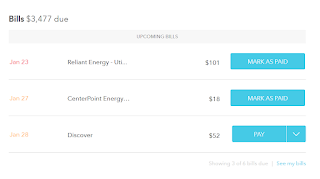

Man, still wanna read more, you are here which means you are not yet convinced or you just want to read the whole post. Well ok, this money management tool has integrated a bill pay feature that allows you to pay your bills also. This is a relatively new feature, which honestly, I haven't used, because a lot of my bills are on auto-pay from a credit card and I use Debitize to set aside money for all my credit purchases and automatically pay off the credit card balance (see more on Debitize here). You started the year with goal for better finances, so why not set up a goal for that next trip to Hawaii, or for a new TV, or to start investing, or an emergency fund for those times you spend more than you make (like I did this month 😆😆). Mint facilitates you to do this for multiple goals and it integrates in with your income and budget so your goals are realistic and measurable. Come on, this has to be enough info here for you to sign up now right here!

If you are still here that means you are really hard to please or determined to finish this post. If you have been using Mint as long as I have the trends section can tell you the history of your finances from when you start and you can see your changes across a lot of financial metrics to help grade your progress towards financial wellness for 2017 (see the above picture).

- Track your spending

- Create a budget

- Set a goal and track progress towards it

- View your FICO score

- View your net worth

- Pay bills

- View your financial trends

Centralized View

I have to dust off my knowledge on this topic as I have been using Mint every since 2010. I can remember when I was trying to improve my finances and in a retirement seminar it (Mint) was mentioned by one of audience members. I took a note and went home and looked it up online and I've been hooked every since. One of the problems it solved for me was that I could see all of our bank accounts, credit cards, loans, and investments in one centralized place. It gave me just about as complete a snapshot of our financial health as I can think of in one place. For instance, this was great because I no longer had to login to each bank account to see our balances or a transaction as it was all shown in my Mint account. Does this sound like a service you can used to achieve your goal? If so, do not delay, go sign up right now by clicking ==>> here.

Track Your Spending

Still not convinced if you have made it here, but I still will try to convince you if you are trying to get your financial house in order. What better way if your financial picture is all in front of you either in a graph or simple text? Mint organizes and categorizes purchases if it can identify the merchant which you made the purchase from. I should note one thing here is that to have this tracking and categorizing to happen automatically you need to use some form of an electronic payment like a credit or debit card. If you are doing this you will see items get bucketed under, for example, Auto & Transport or Food & Dining, etc. One of the first things you need to know to get your finances in shape is to know where your money is going and Mint will provide you the nitty-gritty details without need for manual intervention. If I remember correctly, when you get started it gives a template budget based upon looking at your previous 3 months of transactions. You can then edit the budget from there if you need or want to. Personally, I use the budget simply as a guide to see I'm not spending more than I make. By the way, this is the second way to shape up those finances by not spending more than you make. Mint will help you to see if you are doing that. Enough info yet to get you to sign up? Here's the ==> link.

Bill Pay & Goals

Man, still wanna read more, you are here which means you are not yet convinced or you just want to read the whole post. Well ok, this money management tool has integrated a bill pay feature that allows you to pay your bills also. This is a relatively new feature, which honestly, I haven't used, because a lot of my bills are on auto-pay from a credit card and I use Debitize to set aside money for all my credit purchases and automatically pay off the credit card balance (see more on Debitize here). You started the year with goal for better finances, so why not set up a goal for that next trip to Hawaii, or for a new TV, or to start investing, or an emergency fund for those times you spend more than you make (like I did this month 😆😆). Mint facilitates you to do this for multiple goals and it integrates in with your income and budget so your goals are realistic and measurable. Come on, this has to be enough info here for you to sign up now right here!

Your Historical Financial Trends

If you are still here that means you are really hard to please or determined to finish this post. If you have been using Mint as long as I have the trends section can tell you the history of your finances from when you start and you can see your changes across a lot of financial metrics to help grade your progress towards financial wellness for 2017 (see the above picture).

I will not be able to convince you with Mint's Investment feature as this my least favorite. It shows some stuff but has been largely inaccurate other than showing the balance numbers correctly. I would honestly suggest using Personal Capital if you are tracking your investments and they are also a money management tool like Mint, but it has not had as much sway as Mint did with me partly because Mint supported a lot more of the companies I used. If you use Personal Capital for viewing your investments, just don't answer the sales person calls.

Last but not least, this is a "free" tool to use. Mint does give you recommendations for products and services in different categories, but please understand, this is how they keep the product free for you is through referrals. They have actually suggested some services like Motif and Acorns which I personally use. Again it's free, so sign up and if you don't like it, leave a nasty comment on this blog below.

All things considered, this is a fabulous free money management tool. So go use it, your finances will thank you!

PS: Please share your experience if you are already using Mint or

have questions by leaving a comment on this post. Also please be sure to share this content with your friends and family if you find it useful. I thank you in advance. You can also see what topics are on deck to the right.

have questions by leaving a comment on this post. Also please be sure to share this content with your friends and family if you find it useful. I thank you in advance. You can also see what topics are on deck to the right.

No comments:

Post a Comment