Building Wealth

Building Wealth

The image to the left shows stacks of hundreds that become bigger stacks of hundreds and so on which is indicative of financial wealth building. We want to make our money grow to sustain our lifestyle not only today but in the future as well. This wealth accumulation and growth will help take care of us and our families. How to build wealth is a process and it doesn't just happen over night. So, if you were looking for get rich scheme then this is not it. This is about how to be wealthy by automating your finances which will bring about steady consistent wealth accumulation over time one stack of hundreds at a time.

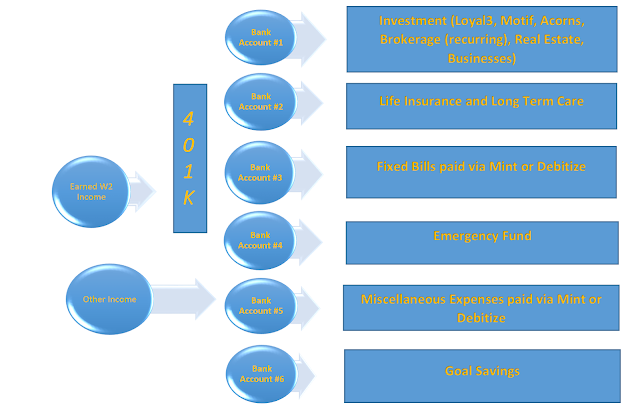

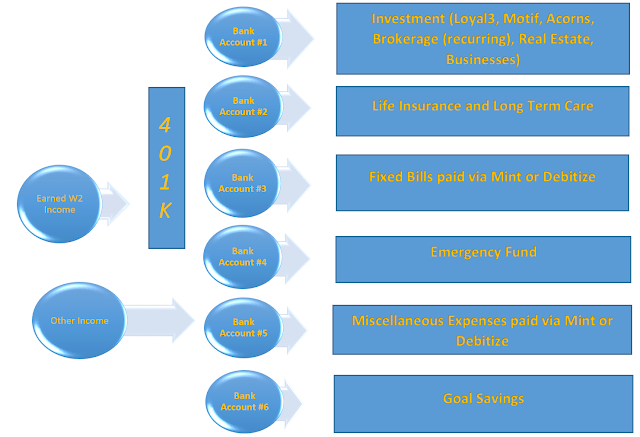

The Diagram Flow Model

The model below is my pictorial representation of how your money should flow through this automated system for optimal

wealth accumulation. Without all the automation pieces this is basically how I run the money we make through these different boxes and I am moving more into trying to automate all my finances for the income that comes into our household. It has helped me go from negative net worth to over $380,000 in the last 7 years. I should note that I have only really started exercising the principals of sound financial practices in the last 7 years. I can just imagine where I would be had I started in my twenties, but hindsight is 20/20 and for some reason, I think we just ignore any type of financial education during that timeframe until we realize I have been working for 10 years and I don't have anything to show for it.

Income Inputs

Let's start out the flow is from left to right where your income comes in either from W2 earned income or some other source. The 401K is just for if you have income from an employer that provides a match to any contributions you make up to a certain percentage. For me, my employer matches any contributions I make up to 6% of my salary. I only suggest to contribute up to the max amount they match and beyond that you can invest outside in brokerage accounts which have a lot more options, perhaps, than your 401K (see What to Invest In 401K?). Any other money flows through and into your 6 bank accounts. It is fine if you have one main landing bank account and from there automated transfers occur to move money needed to pay for items in the other boxes. The main part of the wealth building occurs in box 1 - Investments and potentially box 2 - Life Insurance and Long Term Care. The other boxes, including box 2, are to keep things afloat and moving in the right directions to towards wealth.Investments

If you have invested 6% to 401k, another 4% - 14%, should go towards items in this box for investment type activities, like creating business, purchasing positive cash flowing rental real estate, purchasing stocks, bond, options in platforms like Motif, Acorns, Options House, Vanguard, Loyal3, etc. In the book, the Richest Man In Babylon, they suggest paying yourself first and their metric is 10%, but the more you can invest the better. I have written about some of these in previous blogs and have provided the links on the names for further information. This is one of the only avenue where your money has a chance to compound and make those small stacks of hundreds to add up.Life Insurance & Long Term Care

Next, in box 2 is for Life Insurance and Long Term Care (LTC). These in some cases are to protect the wealth you have been building and provide continuity to your family living the lifestyle they have been accustomed. I only came to know about LTC in my thirties, but I can see firsthand why it is important to have and for those that say I don't need that, I say to you, "Pay now or potentially pay later!" See the stats in this old article, but quite staggering 40 Must-Know Statistics About Long-Term Care. You should at least have a Term policy, but if you can afford Whole Life policy, do so because there are various ways which I will speak on a later blog post that you can utilize the cash value all the while having a death benefit.Fixed Expenses

Next, we should all have a general idea of when we get paid and how much we get paid. If you have a budget, you probably have an idea of how much those fixed bills are going to cost like for Netflix, cell phone, etc. You can have x dollar amount to be transferred on, if you get paid on the 1st, the 2nd into a bank account for fixed expenses. I mention to be paid with Mint or Debitize because I encourage the use of Mint for money management and they happen to have a bill pay feature; however, recently I have been using Debitize because those fixed cost would go onto a credit card which Debitize would manage and pay for me and I could capitalize on getting points/miles for award travel. It doesn't have to be these, but hopefully it will be something that is automatic.Emergency Fund

Next, an Emergency fund is a good thing to have to avoid making bad decision to potentially put stuff on a credit card which you know you have no intention to pay off quickly and you maintain a balance. I typically would just try to keep $1000 in this fund though you might have heard others say more. This is up to you but this gives a cushion for those unexpected expenses that always pop up.Miscellaneous/Variable Expenses

Next, is box for miscellaneous or variable cost items were you will try to find the averages of these items and put money in this bank account and again Mint and Debitize can be used to pay for items out of this box.Goal Savings

Finally, the goal savings box is for saving up for that trip, or that new/used car, or a new TV. This is the box that you use for purchasing the aforementioned items. This gives a little delayed gratification to your spending so that in some cases you don't have to take on as much debt/financing.In Closing

This has been the method I used to get to where we are today financially and I'm 40 now, if we can do about $380,000 every 7 years for next 14 years, that will be 1.14 million by age 54. I believe that will be more than enough for me and my family. Wealth is relative to what you make and building it is a process that takes time, but you can automate that process, which should free up your time to do other meaningful things in life. By using the model like mine to begin with, you too can build consistent and sustainable wealth one stack of hundreds at a time. If you haven't already, take action and get going, preferably when you are young as time is the difference maker. |

| Richest Man In Babylon

Subscribe in Follow by Email on right!

|

No comments:

Post a Comment