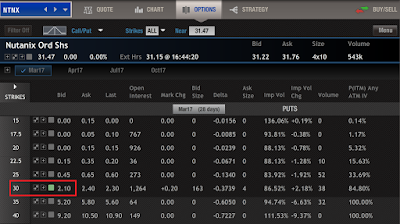

In my previous blog post, Trading Options Secured Put and Covered Call, we were using an active options trade for Nutanix (Ticker Symbol: NTNX) with an open question of how it would close at its expiration on the 17th of February (third Friday of the month). Well the answer to that question has come and NTNX closed at $31.47 and on Saturday the stock was called away from me at my $30 strike. Again, I did not capture that $1.47 appreciation as my gain was capped at

my premium of $95, because like I said, I wanted my money back.

I got $2,994.97 back on the 18th minus commission $4.95 and $0.08 fee, so to recap what happened is - first I leveraged my cash, was assigned the stock, then I leveraged the stock, and it was called away, and I got back my original cash investment (minus commissions and fee) and I can start the process over again on the same stock or another if I like. My initial investment was $3,000, and I received $351 + $89 = $440 in premiums over a 63 day period for return on investment (ROI (net profit/cost of investment) x 100) before taxes of 14%.

| Nutanix Stock Called Away |

|

| Nutanix Put Side Option Premium |

|

| Nutanix Next Earnings |

Subscribe to my blog @ http://oslifemoneypoliticsnotherthings.blogspot.com or on the right side of this page in the Follow by Email box.

Please

provide feedback or questions pertaining to this blog post by leaving a

comment below. Also please be sure to share this content with your

friends and family. I thank you in advance.

Please

provide feedback or questions pertaining to this blog post by leaving a

comment below. Also please be sure to share this content with your

friends and family. I thank you in advance.Also, next time you think to shop at Walmart online, how about clicking through on the link below. It will be appreciated, but also check out my blog post Loyal3 10 Stock Plan. If you are spending money in Walmart, you should be owning it too!

No comments:

Post a Comment