High Yield Saving Accounts

High Yield Saving Accounts

I was moving some money around in savings accounts that I opened some time ago and after writing the blog, "Loyal Only To Next Big Sign Up Bonus", it got me to thinking had I been resting on my laurels when it came to where I had money sitting for future bills to be paid for taxes, insurance, or savings. I had vetted out these savings accounts 4 years ago that they were yielding the most at the time, but I hadn't checked in awhile until just this past week how they still fared. Time For Some Changes

What I found is that I have some changes to make to get a higher rate of return for this money that is mostly going to accumulate and sit around until I need to pay it out. Here is what I found for the current state of my accounts as far as there yield amounts:Bank Yield

Ally 0.85%

MySavings Direct 0.85%

Capital One 0.60%

Salem Five 0.90%

FNBO 1.82%

Discover 1.10%

I compared two sources for the highest rates I could get now using Mint.com and Magnify Money. I found 6 banks which offer higher yield than all but one of the accounts I had. Personally, I don't mind an online bank as I currently have banked remotely with USAA for over 20 years and I have yet set foot in their home bank in San Antonio and I've been able to do all I want to do as far as banking just fine.

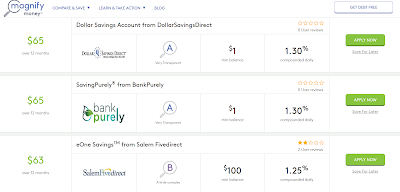

Magnify Money Results

Mint Results

Based upon these results, I will be opening two new savings accounts in Dollar Savings Direct and Bank Purely for the 1.30% as I can't get the rate I currently get if I were to open another FNBO account now.

New Accounts For $ To Sit In

I'll use these savings accounts to segregate out 4 buckets of funds I have to put aside for future. The setup will probably be something like follows:- FNBO - Property taxes and taxes for investment income from options trading - 1.82%

- Dollar Savings Direct - Mini Emergency Fund of $1000 - 1.30%

- Dollar Savings Direct - Home Owner's and Flood Insurance - 1.30%

- Bank Purely - Tenant Security Deposits - 1.30%

I like this setup as it's an increase of almost 50 basis points over if I do nothing.

In Closing

I had been resting on my laurels and even I need to be shaken out of a slumber every now and then. If you have some cash just sitting around why not use this time to evaluate can you too do better. If these rates are higher than what you are getting at your current bank, it may be time to switch as again that question of why you are loyal comes up again if the bank is not offering you better value?

Check out my Affiliate and Referral links here for products in services to help with investment, credit, cashback, and award travel. Also you can find more of my blog post on Start Here.

Please provide feedback or questions pertaining to this blog post by leaving a comment below. Also please be sure to share this content with your friends and family. I thank you in advance.

Please provide feedback or questions pertaining to this blog post by leaving a comment below. Also please be sure to share this content with your friends and family. I thank you in advance.

Also, next time you think to shop at Walmart online, how about clicking through on the banner ad at the bottom of my blog site. It will be appreciated, but also check out my blog post Loyal3 10 Stock Plan. If you are spending money in Walmart, you should be owning it too!

Check out my Affiliate and Referral links here for products in services to help with investment, credit, cashback, and award travel. Also you can find more of my blog post on Start Here.

Subscribe to my blog @ http://oslifemoneypoliticsnotherthings.blogspot.com or on the right side of this page in the Follow by Email box.

Please provide feedback or questions pertaining to this blog post by leaving a comment below. Also please be sure to share this content with your friends and family. I thank you in advance.

Please provide feedback or questions pertaining to this blog post by leaving a comment below. Also please be sure to share this content with your friends and family. I thank you in advance.Also, next time you think to shop at Walmart online, how about clicking through on the banner ad at the bottom of my blog site. It will be appreciated, but also check out my blog post Loyal3 10 Stock Plan. If you are spending money in Walmart, you should be owning it too!

No comments:

Post a Comment